Water Control & Improvement District No 17 (WCID No. 17) is a non-profit public utility providing quality water and wastewater services to customers in the Lake Travis South area along RR 620 in West Travis County. The District uses Debt Obligation to ensure adequate and sustainable resources to finance our present and future water and wastewater infrastructure projects. Each Bond Resolution requires the District to levy and collect sufficient ad valorem tax for debt service for timely payment of interest, principal, and the costs associated with assessment and collection of taxes. The District has satisfied our Bond Resolution requirements and the funds are sufficiently allocated to meet our Debt Service Requirements.

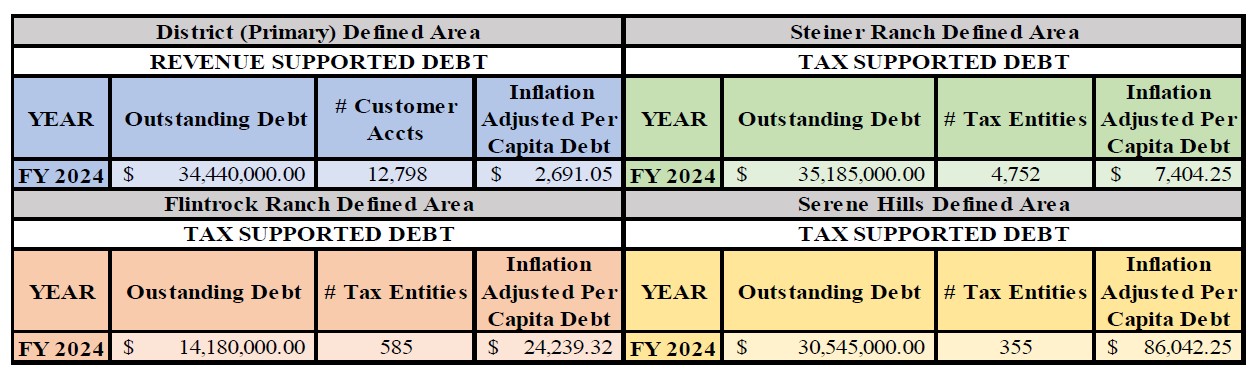

As of September 30, 2024, the District’s cumulative outstanding debt obligations total $114.350,000; of this total amount of debt obligation, $34,440,000 is supported by operational revenue, and the remaining $79,910,000 is serviced using collected taxes. The graphic below further classifies the District’s debt for each Defined Area by Taxable Entity population.

The District leases vehicles under a master equity lease agreement. The lease term begins upon delivery of the vehicle, and the lease have an initial term ranging from twelve to sixty months, with the option to continue month -to-month for an unlimited period of time. Payments are due monthly and range from $484 to $1,176.

As of September 30, 2024 the value of the lease liability is $156,510. The lease has interest rates ranging from 0.49% to 3.72% . The value of the right to use asset as of September 30, 2024 is $153,356, net of accumulated amortization of $197,001.

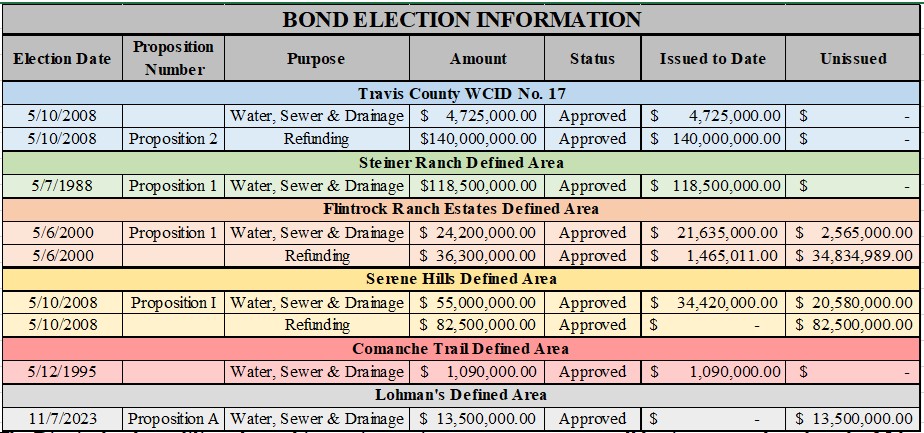

Below is Historical Bond Election Information for approved/authorized bonds for the District as of most recently completed fiscal year. Currently there are no other scheduled Bond Elections.

The District has been diligently working on improving transparency across all business areas based on the 85th Legislature passed in 2017. The bill requires certain special purpose districts to annually provide records and other information concerning district finances, debt obligation and tax rates to the Comptroller of Public Accountants (See Senate Bill 625 (SB625)). SB 625 also required the Comptroller of Public Accounts to create the Special Purpose District Public Information Database, where information submitted by the districts will be assembled, updated, and made available to the public free of charge and that database can be found here: https://spdpid.comptroller.texas.gov/

Link to Bond Review Board local government debt data: https://www.brb.texas.gov/

Link to Texas Comptroller of Public Accounts Debt at a Glance tool: https://comptroller.texas.gov/transparency/local/debt/texas.php

Travis County Property Tax rates: https://www.traviscountytx.gov/tax-rates